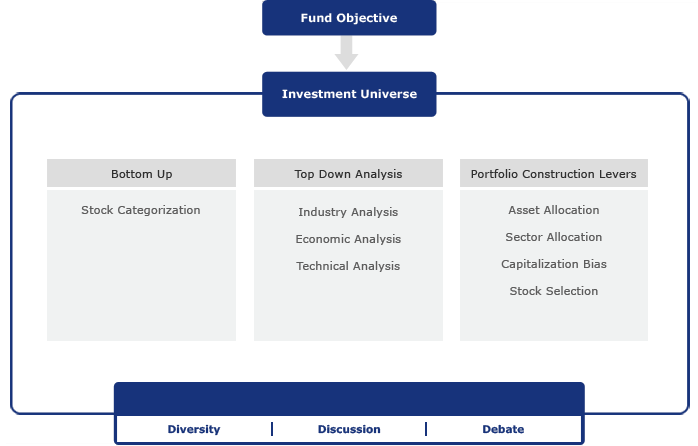

Our equity investment philosophy is centered on

generating capital appreciation for the investor.

The primary emphasis is on providing the investor

with a degree of capital appreciation, superior to

that of the returns from the equity class as

represented by a market index over the longer

term. Our core investment premise is that the

equity markets are not completely efficient. A

well-organized and thorough research effort

combined with a disciplined portfolio management

approach will enable out performance of the market

index over time.

A key pillar of our disciplined approach is to

stay true to the mandate of the specific fund as

specified in the offer document under all

circumstances. This is key to generating superior

performance over time even though there could be

times when staying true to the mandate may result

in short-term underperformance. Our investment

philosophy is a matrix framework of Company,

Industry, Economic and Technical analysis. The

equity team will provide many of the inputs for

this framework, but we will also use inputs from

external sources as and when required. This open

framework is combined with an environment that

encourages regular and constant debate; which we

believe leads to superior decision making.

Stock categorization

system

The objective of our stock

categorization system is to enable us to identify

stocks that are likely to be the best investments

from within our universe. Each category of stock

has a description of fundamental attributes that

we expect the company to possess. The

categorizations are as follows:

Stock

Category |

Descriptions

(eg.) |

Growth

Prospects (eg.) |

Company Attribute

(eg.) |

Financial

Parameter (eg.) |

| Star |

Young companies |

High growth |

Entrepreneur vision,

scalability |

Operating Leverage |

| Leader |

Established companies |

In line or better

than industry |

Track record of

leadership, globally

competitive |

Industry leading

margin / ROE |

| Warrior |

Young / established

companies |

Better than industry |

Unique proposition

and / or right place,

right time |

Margin & ROE

expansion |

| Diamond |

Company with

valuable assets |

Low growth |

Management intent

to unlock value |

Value of asset /

business |

| Frog

Prince |

Company in a

turnaround situation |

Back to growth |

Intrinsic strengths

in core business |

P2P, ROE expansion |

| Shotgun |

Opportunistic

investment |

Positive surprise |

Corporate event,

restructuring,

earnings news |

Event visibility |

| Commodities |

Call on the cycle is

paramount |

Positive |

Integration, cost

efficiency, globally

competitive |

Profit leverage |

| * P2P - Path to

Profit, ROE - Return on Equity |

| Stocks

that fit into one of these categories typically

display superior return profiles, but more

importantly this enables fund managers to focus on

the attributes that drive stock price performance

and keep a watch for red flags. |